4 Stocks To Watch As Home Price Increases Slow

7 min read

imaginima

A slowdown in housing prices will have myriad effects on modern overall economy. Unquestionably, it is an indicator of slowed homebuying as home loan prices increase. It also usually means wrecked domestic prosperity, in which actual estate is exactly where most of the home wealth is saved. It indicates a common drop in house paying, as mortgage loan premiums increase and crimp on residence incomes. It is generally a lousy indication for the economic climate. But due to the fact of the conversation with provide chain challenges and challenges with economic productivity, there are some places and normally takes, with new means to enjoy the housing slowdown apart from getting really defensive. Thus we offer 4 ideas related to the slowdown in housing price ranges in buy of speculative risk for investors to contemplate.

The Hottest in Housing Markets

The hottest in housing marketplaces is that selling prices are finally finding slice, primarily in locations wherever the run-up was most intense. Soaring property finance loan rates are of system catching buyers in lousy positions, and triggering some shedding of investments as buyers re-evaluate their needs versus affordability. Correct now, it is unclear if what we are looking at is a correction or the starting of a crash. With loan expansion having accelerated these final couple of many years, there is absolutely a possibility that LTVs are increasing on a fantastic proportion of loans that have been skewed toward recent originations. At the moment, the corrections are amounting up to 15% in some big Californian markets, with other vital US cities viewing a equivalent decrease as very well. No indications of a crash however, but the interaction with home wealth is a issue, and is the motive why some are sounding the deleveraging alarm. If a deleveraging takes place, no placement is harmless besides for shorts towards the market place. We assume a deleveraging can be averted, but at the cost of cycles in the items and housing markets, possible having down inflation at the cost of financial advancement. We really don’t believe there was a great deal reason to increase fees, but it is occurring, so how can traders place?

Profits Tips

Although dividends, academically speaking, increase very little in conditions of the return benefit, in a time period like ours where by we are working with elaborate financial forces that can be confounded by rather fickle political forces, obtaining a head-start out on returns with a dividend is a excellent concept. In purchase to do that efficiently, we offer numerous shares that make dividends from an income base that is alternatively dependable over a bear current market horizon of eight months to two decades.

ING Groep (ING)

The initially cash flow idea is ING Groep. There are a number of factors going for ING if you are looking at it for an money participate in. The very first is the sizing of the generate, which is at 7.5%. This somewhat intently mirrors the earnings yield, which is about 12% because of to the really lower PE various of 8.5x. The unfold among people percentages represents the superior earnings coverage of the dividend with a payout ratio that is not alarming.

What are the forces undergirding the ING dividend? First of all, look at that ING, as opposed to other European banks, benefits from a very large proportion of its cash flow coming from fascination as opposed to price and commerce volume cash flow.

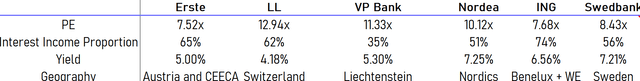

Financial institution Spread (VTS)

This is preferable given economic downturn issues. The other thing that ING rewards from is that the financial loan progress of new years, especially of mortgages, has been skewing toward more time-time period property. These belongings are likely to be a considerably variable level, whilst specific disclosure is not presented, so as premiums rise in Europe as nicely, we should see an improving margin there. The risk to the thesis is slowing personal loan expansion, but as stated, the somewhat balanced proportion of longer-time period financial loans offers ING a runway in advance of earnings route becomes a worry.

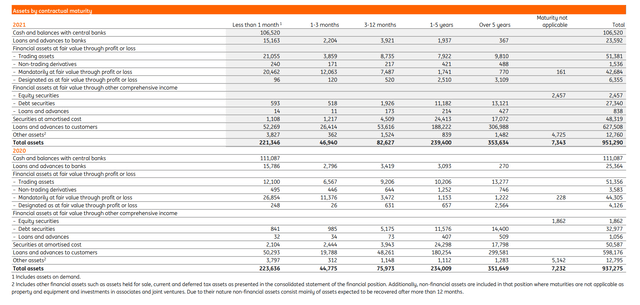

ING Assets (Once-a-year Report 2021)

Gaming and Leisure Qualities (GLPI)

We go additional into the thesis about GLPI in our other recent report, but it is well worth mentioning below as a risk-free REIT money play in the existing surroundings. With REITs typically outperforming in bear marketplaces, and the regional on line casino footprint getting significantly resilient in the US due to demographic, conclude-marketplace and political aspects, we imagine GLPI deserves fairly a ton of credit as a risk-free haven. Lease adjustments per year maintain it hedged from a diploma of inflation as effectively as fee hikes. In addition, the specialised belongings have extra of an asset worth thesis than just the lower-level atmosphere, for example, the require for on the internet operators to partner with present physical casinos and their related licenses. It truly is a great income concept for folks that really don’t want to get the danger of sitting on the sidelines, exactly where REITs also outperform in the reversal of a bear current market as well as in the down-cycle of the marketplace. The 6% dividend yield is sufficient, and the heritage of paying it is terrific with the exception of pausing the dividend and generating it a share dividend throughout the pandemic, but they can be excused for that provided the outstanding exposure casinos had to that headwind.

Cost Appreciation Strategies

When earnings is a great principle to weather conditions a economic downturn, we also provide some additional speculative thoughts that traders ought to take into consideration that even now relate to a housing price tag slowdown and larger premiums.

Westlake (WLK)

The 1st is a setting up products strategy. We carry on to sustain that a cooling off of the merchandise industry may conclude up staying a superior issue for constructing products and solutions companies. Interfor (OTCPK:IFSPF) has had to pause creation, in which sawmills made use of to be at utmost utilisation in 2021, mainly because logistical bottlenecks created it unattainable for customers to offtake the materials. Westlake, which presents ending for residences, will also be hindered by logistical issues. The added advantage that Westlake has about Interfor, wherever Interfor sells products into the previously phases of the creating cycle, is pent-up demand from customers, since finishings are in shorter source now since the creating cycle is at the phase in which it can be trying to complete stock. With the housing shortage becoming a extended-expression secular dilemma in the US, exacerbated by zoning concerns and politics, but also demographics such as late household development by millennials, starting up to kick in now, there will always be a desire sink for Westlake.

Westlake produces a lot more specialised products and solutions as very well as commodity supplies for residence finishings in contrast to complete commodity setting up item organizations like Interfor. Regardless of secular forces, they trade at considerably less than a 5x PE many. We feel this is an intriguing prospect for buyers.

Dollar Common (DG)

Greenback Common is a really uncomplicated concept for the latest surroundings. With a housing slowdown being inextricably connected with a strike to residence wealth, considering that so significantly of households’ prosperity is tied up in housing, price cut shops make sense for the purchaser condition that is to occur. Plummeting buyer self-confidence and the obvious onset of a recession is a little something that added benefits Greenback Basic on two fronts. To start with, its topline must be preserved if not a beneficiary from a decrease in cash flow. Also, its base line has been hurt by inflation. With mounting costs eventually likely to dent inflation, since the Fed has been apparent that inflation can’t be allowed to continue on (no matter whether we agree or not), the bottom line ought to also incrementally improve.

Over-all, DG funds are heading in the correct way provided the economic natural environment.

Its money profile is also really sturdy. A 50% EBIT to FCF conversion is pretty respectable, specifically currently wherever bloated inventories are a requirement presented source chain worries and new provide chain administration principles. These conversion prices are most likely at a trough now and will only strengthen. The numerous is reasonably entire at 14x EV/EBITDA, but that is the price of acquiring a secure investment decision that in all likelihood will be just one of the several equities that will increase in the present-day ecosystem. With returns needing to outrun equally premiums and inflation in a stagflationary setting, the price tag of development assurances as perfectly as incremental margin improvement will be elevated. But with 14x symbolizing a reasonably normal several in the threat-on surroundings preceding our current chance-off ecosystem, it is really by no signifies a bitter rate to pay back.

Bottom Line

With the slowdown in housing prices coming alongside one another with better premiums and also destroying domestic prosperity and disposable profits, a economic downturn is coming as very well as a correction-turned-bear market place in the inventory sector. Investors really should be thinking of the two technical security from harmed returns in the selection of their securities, but also in the business styles that underlie them. Earnings is a reward now to get a head-begin on returns where funds appreciation will be a lot less trustworthy. REITs and interest-based mostly revenue are attractive, as are inferior products. Extra speculatively, merchandise corporations hampered by bottlenecks are a good concept much too, if they are specialised to resist a commodity reversal with some pricing energy. We offer you an plan in every of these categories and consider that amongst them are opportunity outperformers in a somewhat treacherous marketplace setting.

.jpg)