9 Ways to Invest in Real Estate for Retirement

8 min read

Investing in actual estate is a person of the oldest varieties of investing and several people consider it to be a safe and sound financial commitment as opposed to other more volatile investments like stocks. This is because conventional authentic estate investing, or acquiring rental properties, presents extra stability than the inventory industry does.

Because of – Thanks

When you buy a residence or apartment making as a rental assets, you you should not have to fear about the worth likely up and down each individual working day.

Instead, you can hope that your income will grow steadily in excess of time as extensive as you hold investing in attributes that give dollars stream and value in benefit. While there are a lot of approaches to make investments in serious estate, this short article will target on how you can get started out by buying single spouse and children properties or business buildings for yourself.

Commit in assets that you previously have

It truly is hard to beat the safety of your personal home, primarily if you might be setting up on remaining put for the extensive haul. Practically 80% of senior citizens owned homes going into 2022.

“When you very own a dwelling, it is really doable to pay down your house loan debt and develop fairness at the exact same time—both of which are desirable retirement financial commitment procedures,” claims Cliff Auerswald, President of All Reverse Home finance loan. You can also lease out rooms or even move into a smaller rental residence and rent out the rest of your house!

- Obtain a multi-loved ones house or business setting up

If residing in a single location isn’t really an choice for you appropriate now, take into account investing in a multi-household property or industrial setting up where other men and women will be spending hire while earning your home finance loan payments for you each month (and perhaps even spending off some of its principal).

When this type of serious estate may have to have a bit far more upfront funds than one spouse and children households do, there are normally tax gains linked with proudly owning a number of qualities as perfectly as enhanced possible for advancement in excess of time if done effectively!

Devote in a REIT

An additional way to invest in genuine estate is by a REIT– It owns roughly $3.5 trillion in gross authentic estate belongings, with extra than $2.5 trillion of that overall from public stated and non-shown REITs and the remainder from privately held REITs. or serious estate expenditure trusts. REITs are firms that personal earnings-manufacturing true estate and then provide shares of on their own to investors.

You can consider of investing in a REIT as a way to make investments in true estate devoid of really owning any assets by yourself. These entities are traded on stock exchanges like any other publicly traded business, which indicates you get some liquidity—and with any luck ,, far better returns—compared with obtaining and offering particular person homes.

Devote for income movement

Money move is the amount of money of revenue you receive from hire and other money. It is really a critical indicator of whether or not a residence is a great expenditure, simply because it demonstrates how effectively a residence is creating earnings. If the money movement is not there, you may well not be able to afford to pay for mortgage payments and servicing expenses.

When numerous investors aim on house-value appreciation—how considerably their house has greater in value given that they acquired it—you should really take into account money movement as your most important problem when determining no matter whether or not to get serious estate for retirement.

Your purpose is to have plenty of money left more than following paying out all your expenses that you can reside comfortably without the need of obtaining to work once again!

Flip properties for revenue

Flipping attributes is a dangerous proposition that can be a great system when the sector is hot. The flip requires purchasing a house, repairing it up and then offering it at a earnings. “If you’re willing and able to just take on some hazard, this system can pay back off major,” states Kevin Bazazzadeh, Founder of Amazing Day Households.

There are pitfalls included with flipping properties mainly because you have no assure that you can make dollars immediately after all your expenses (such as renovations) have been paid for.

Even if the actual estate sector has bottomed out and is about to transform all-around, there are no ensures that your residence will offer for extra than what you purchased it for—or even cover what you have spent on repairs.

Obtain a holiday rental assets

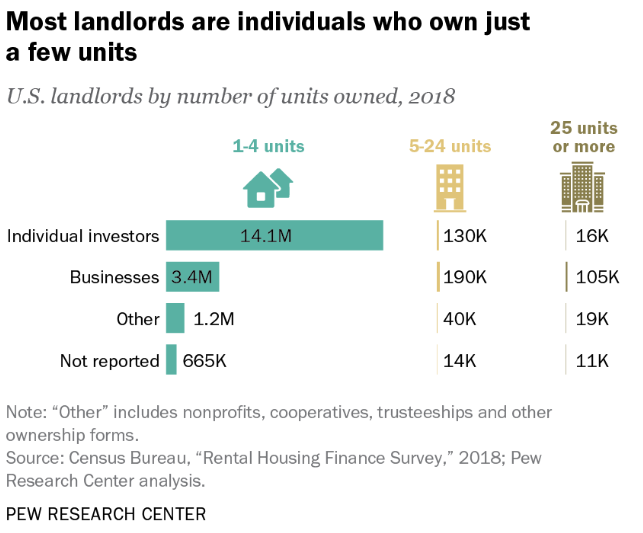

When it comes to investing, the most effective forms of houses are these that can crank out passive cash flow. This usually means you can get and lease out the house without owning to control it whole-time. Individual authentic estate buyers account for 72.5% of rental homes in the United States.

Holiday vacation rental qualities in shape this criteria properly. You can expect to be ready to use your investment decision as a secondary profits stream, offsetting the costs of possession with rental payments. And if you’re not relaxed controlling tenants or working with maintenance difficulties, there is always Airbnb!

According to Alan More durable, a Vancouver home loan broker, “the critical below is to make guaranteed you select a family vacation rental residence that has an recognized market place and desire for rentals in get for it to be successful for the two you and any probable tenants – that way, no a person loses out.”

Invest in a very long-phrase rental property

- Locate a property. Whether you might be looking for an condominium setting up or a residence, you want to locate a place that is escalating and has fantastic likely for rental money.

- Calculate the ROI (Return on Investment decision). There are numerous variables that go into calculating the ROI of your property—the selection of bedrooms, rate per sq. foot, and many others., but a single detail continues to be frequent:

- Your month-to-month lease must deal with all costs and then some far more each and every thirty day period in buy for it to be an financial commitment truly worth pursuing.

- Obtain a tenant who will fork out on time every month with out are unsuccessful! This can be tough if you don’t have prior knowledge executing this type of factor by yourself (or if you’re just starting up out),

- so it could possibly be sensible to retain the services of a assets administration business that can aid with this move when also fixing any other complications that may crop up right after shifting tenants in or out of the household/apartment creating by itself in excess of time as nicely as controlling repairs

Get and change place of work place to residential units

Changing business office area to household models is a very good expense for retirees. One of the main reasons for this is that underutilized places of work are normally located in good parts, and they’re less costly than household homes.

Also, changing office room to residential models suggests that you can get extra use out of the assets by furnishing it with more price.

This is primarily genuine if you stay in the vicinity of an region wherever there are not many locations for men and women to rent or obtain homes but have to have them anyway simply because they work in a close by town heart or business district all through weekdays but don’t like keeping at resorts on weekends.

Order a multi-family dwelling and stay in just one unit although renting the other folks out.

If you’re searching to obtain a multi-household dwelling, there are a couple issues to think about.

- You can live in one unit and hire out the others. “This is a good way to earn passive money as you’ll be amassing lease payments from tenants when you are living in your have dwelling,” notes Rinal Patel, a Licensed Real estate agent and Co-Founder of We Invest in Philly Residence.

- You could also make your mind up to acquire a multi-family property and lease all of the units, leaving yours vacant until it gets readily available. In this case, you’d have to have access to a further source of money that will pay back for your home finance loan while waiting for renters who want to transfer into their new homes—and perhaps give back again some of that money when they go away!

Companion with yet another trader on a deal (or two or three)

If you might be not an skilled, it can be really hard to know how a lot to fork out for a property and how to discover excellent deals. A single way to mitigate the chance is by partnering with other investors on a offer (or two or a few).

With far more men and women included in the obtain, there are a lot more eyes on just about every phase of the system and a lot more people today who can assistance make selections about which attributes are worth pursuing.

If you might be wanting for a person to partner with, your best bets include things like on the web platforms like RealtyShares and Fundrise that let investors from throughout the entire world access each and every others’ listings.

If that doesn’t do the job out, try inquiring close friends or household customers if they’d be interested in acquiring included in serious estate alongside one another — prospects are they are going to be happy for your assist! There are also area meetups especially created for acquiring investor associates just research on-line for “true estate investing meetup” in close proximity to you.

There are numerous means to make investments in authentic estate, which include buying residences and commercial buildings, putting dollars into other people’s investments and borrowing to commit in rental properties.

- Invest in a household

- Invest in a REIT (genuine estate financial commitment belief)

- Make investments for income flow

- Flip properties for profit

Conclusion

If you’re wanting for a way to make revenue or gains through retirement, then serious estate may perhaps be the suitable preference for you. There are quite a few distinctive styles of investments that can enable you meet your targets. The very best way to determine which a single will function most effective is by performing investigation on every style in advance of producing any decisions.

I hope this post has offered some perception into the strategies in which retirees may devote in authentic estate.

The submit 9 Techniques to Invest in True Estate for Retirement appeared 1st on Because of.

.jpg)