Home Depot (HD) Rises on Q1 Earnings & Sales Beat, Upbeat View

4 min read

The Home Depot, Inc. HD has posted first-quarter fiscal 2022 results, wherein earnings and sales beat the Zacks Consensus Estimate and improved year over year. The company gained from the continued strong demand for home-improvement projects, robust housing market trends and ongoing investments. It has reported robust average ticket growth amid the inflationary cost environment, boosting the top line.

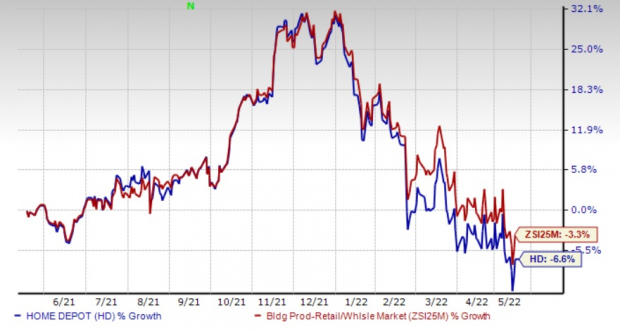

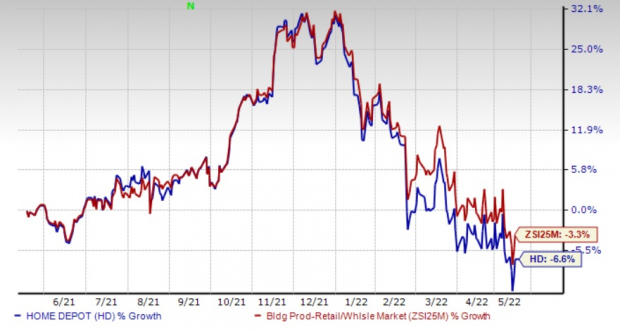

Shares of the leading home improvement retailer rose 3.7% in the pre-market session, following the strong results and raised fiscal 2022 view. The Zacks Rank #3 (Hold) stock has lost 6.6% in the past year compared with the industry‘s decline of 3.3%.

Image Source: Zacks Investment Research

Home Depot’s earnings of $4.09 per share improved 6% from $3.86 registered in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate of $3.66.

Net sales advanced 3.8% to $38,908 million from $37,500 million in the year-ago quarter and significantly beat the Zacks Consensus Estimate of $34,492 million. This marked the company’s highest first-quarter sales in its history. Sales benefited from the continued robust demand for home-improvement projects.

The company’s overall comparable sales (comps) grew 2.2%, with a 1.7% improvement in the United States. In the reported quarter, comps were aided by an 11.4% rise in average ticket, driven by high-value purchases by home builders. This was partly offset by an 8.2% decline in customer transactions. Sales per square foot improved 2.7% in the reported quarter.

The Home Depot, Inc. Price, Consensus and EPS Surprise

The Home Depot, Inc. price-consensus-eps-surprise-chart | The Home Depot, Inc. Quote

In dollar terms, the gross profit increased 3.2% to $13,145 million from $12,742 million in the year-ago quarter, primarily driven by robust sales growth. This was partly offset by a 4.1% increase in the cost of goods sold. Meanwhile, the gross profit margin contracted 20 basis points (bps) to 33.8% from 34% in the year-ago quarter.

The operating income increased 2.6% to $5,929 million, while the operating margin contracted 20 bps to 15.2%. The operating margin benefited from top-line growth, offset by a gross margin contraction, as well as higher SG&A and other operating expenses.

Balance Sheet and Cash Flow

Home Depot ended first-quarter fiscal 2022 with cash and cash equivalents of $2,844 million, long-term debt (excluding current maturities) of $39,158 million, and shareholders’ deficit of $1,709 million. In first-quarter fiscal 2022, the company generated $3,789 million of net cash from operations.

In first-quarter fiscal 2022, it paid out cash dividends of $1,962 million and repurchased shares worth $2,308 million.

Fiscal 2022 View

Following a strong start to the year, Home Depot raised its guidance for fiscal 2022. HD anticipates sales and comps growth of 3% in fiscal 2022 compared with slightly positive growth mentioned earlier. The operating margin is estimated to be 15.4%. Earlier, the company expected the operating margin to be flat with the fiscal 2021 reported level. Net interest expenses are expected to be $1.6 billion compared with the $1.5 billion stated earlier. It continues to expect an effective tax rate of 24.6%. The company estimates earnings per share growth in the mid-single digits for fiscal 2022 versus low-single-digit growth stated earlier.

3 Stocks to Consider

We have highlighted three better-ranked stocks in the Retail – Wholesale sector, namely Tecnoglass TGLS, Boot Barn Holdings, Inc. BOOT and Fastenal FAST.

Tecnoglass engages in manufacturing and selling architectural glass and windows and aluminum products for the residential and commercial construction industries. It currently sports a Zacks Rank #1 (Strong Buy). Shares of TGLS have jumped 15.9% in the past year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tecnoglass’ current financial-year sales and earnings per share suggests growth of 21.3% and 28.7%, respectively, from the year-ago period’s reported figures. TGLS has a trailing four-quarter earnings surprise of 28.3%, on average.

Boot Barn, a lifestyle retail chain devoted to western and work-related footwear, apparel and accessories, currently flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 25.2%, on average. Shares of BOOT have rallied 24.7% in the past year.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales and earnings per share suggests growth of 17% and 4.4%, respectively, from the year-ago period’s reported figures. BOOT has an expected EPS growth rate of 20% for three-five years.

Fastenal, a national wholesale distributor of industrial and construction supplies, currently has a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 5%, on average. Shares of FAST have risen 0.6% in the past year.

The Zacks Consensus Estimate for Fastenal’s current financial-year sales and earnings per share suggests growth of 15.4% and 16.3%, respectively, from the year-ago period. FAST has an expected EPS growth rate of 9% for three-five years.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the Zacks Top 10 Stocks portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Fastenal Company (FAST): Free Stock Analysis Report

The Home Depot, Inc. (HD): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Tecnoglass Inc. (TGLS): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

.jpg)